"The Current State of Digital Asset Custody," a comprehensive report co-created by PwC and Aspen Digital, delves into the pivotal role of digital asset custody in amplifying wealth for institutional investors in Asia. The paper also provides insights into capturing the perpetually evolving opportunities within the digital asset ecosystem. The burgeoning adoption of digital assets has boosted the demand for institutional-grade digital asset custody services, intensifying the competitive landscape. As of April 2023, over 120 digital asset custody service providers cater to this multi-billion-dollar industry with a range of services.

The Imperative of Digital Asset Custody

Grayscale Investments, in "Reimagining the Future of Finance," characterizes the digital economy as the "intersection of technology and finance, progressively defined by digital spaces, experiences, and transactions." Amid this transformative surge, digital asset custody has gained paramount importance. Established financial institutions are swiftly incorporating digital asset custody, acknowledging its critical role in securely preserving client digital assets. Custody forms the bedrock for the creation, management, and exchange of digital assets, facilitating services like trading, banking, and prime brokerage. By early 2022, Assets Under Custody (AUC) saw a remarkable 600% growth, surpassing $200 billion, underscoring digital asset custody as a key component in sculpting the financial future.

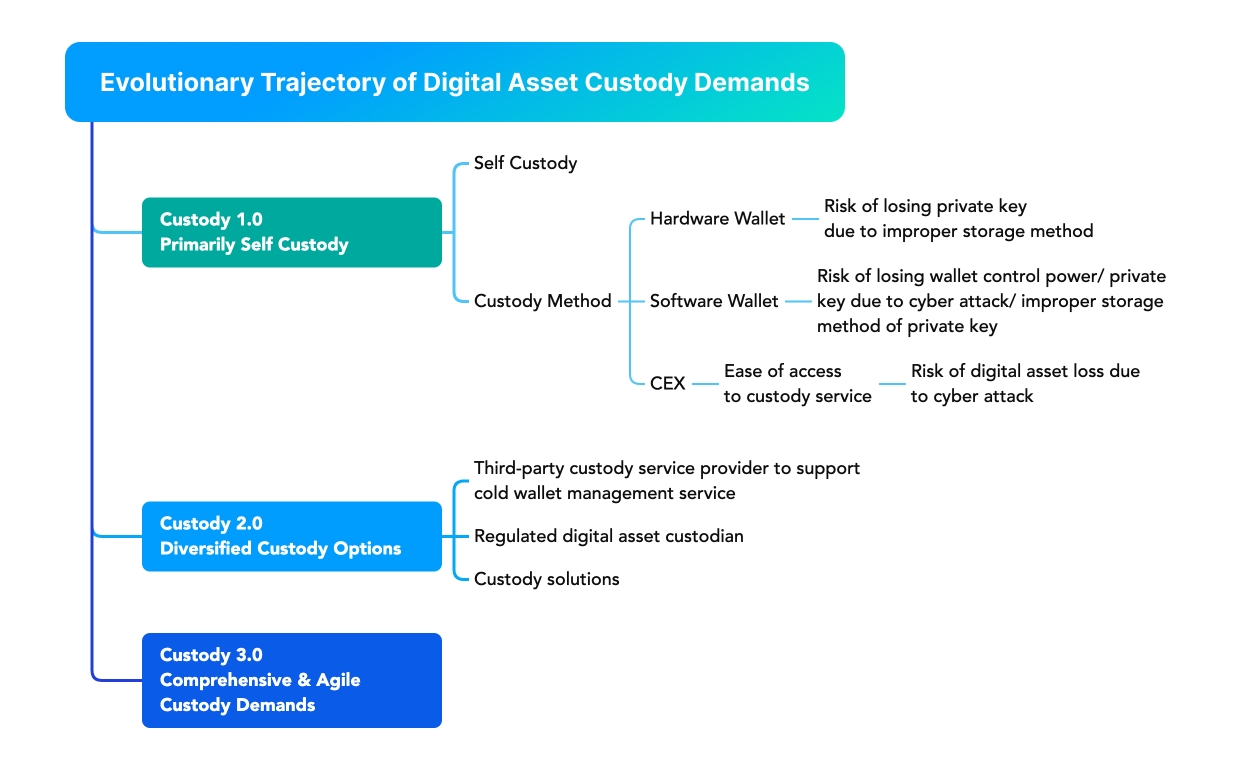

Evolutionary Trajectory of Digital Asset Custody Demands

The development of digital asset custody has distinctly progressed through three phases:

Custody 1.0: Primarily self-custody, with users managing their own private keys and digital assets, this method, though decentralized, lacked safety and efficiency.

Custody 2.0: Institutions initiated the use of offline cold wallets, offering tailored strategies for trustees, accompanied by the rise of regulated digital asset custodians.

Custody 3.0: Digital asset custody service providers are aiding institutions in exploring the burgeoning Web3 ecosystem, seeking more than just security, but also flexible asset custody methods.

Selecting the Optimal Digital Asset Custody Service Provider

An exemplary custodian should present institutional digital asset holders with solutions that reduce risk, streamline complexity, bolster security, prioritize asset retrieval rights, and enhance operational efficiency. Key selection criteria, organized by importance, include:

Security & Technical Support: Ensuring the technical expertise of the custodian is imperative.

Audits & Compliance: Regular audits guarantee continual adherence to safety protocols.

Flexibility & Efficiency: Recently, institutional investors are also seeking profit through the custodian's logical allocation and operation of their assets.

Challenges & The Future of Digital Asset Custody Services

Messari's annual report described digital asset custody as the "junction where the digital asset and the traditional financial world converge." As its significance in the financial ecosystem rises, challenges related to safety, regulatory environment, and solution flexibility become prominent.

Security: The safety of cryptocurrency still hinges on the technical capabilities and safeguards of the custody platform.

Regulation: Even as the global legal framework becomes more accommodating of digital assets, the regulation of digital asset custody remains fragmented.

Flexibility: Ensuring a digital asset custody solution is flexible remains a vital concern.

Established in 2017 and headquartered in Singapore, ChainUp, as an all-encompassing blockchain technology company, provides a myriad of services through its innovative and transformative ethos in the evolving digital economy. The respected ChainUp Custody team, fortified by years of experience, has safely transferred over 10 billion USD in digital assets for more than 300 institutional clients globally. With its four primary advantages, the team has established new benchmarks in the digital asset custody domain. These include being backed by ChainUp, enjoying a commendable reputation in the industry, a multi-tiered security architecture, flexible custody solutions, and professional and efficient technical services.