In today's rapidly evolving financial landscape, payment platforms must adapt to retain their competitive edge.

Integrating digital asset solutions unlocks a treasure trove of opportunities: diversify payment offerings with faster, cheaper cross-border transactions, attract tech-savvy customers seeking innovative financial tools, and generate new revenue streams through custody fees, merchant services, and DeFi integrations. By leveraging blockchain’s security and transparency, payment platforms can enhance trust, streamline operations, and unlock the potential of programmable money. Embracing digital assets is not just about catching a trend, it’s about building a future-proof infrastructure that empowers seamless, secure, and inclusive financial transactions for all.

Key benefits for Payment Platforms adopting digital asset solutions

Faster, Cheaper, and More Efficient Transactions

Cross-border payments without friction

Eliminate intermediaries and reduce settlement times for international transactions, saving time and cost for both merchants and customers.

Lower transaction fees

Leverage blockchain’s inherent efficiency to offer lower processing fees compared to traditional payment methods.

Real-time settlement

Enable instant transfer of funds, improving cash flow and streamlining business operations for merchants.

Attracting New Customers and Staying Ahead of the Curve

Cater to tech-savvy customers

Appeal to a growing segment seeking innovative and convenient payment options, boosting user acquisition and brand loyalty.

Position yourself as a forward-thinking leader

Demonstrate your understanding of the evolving financial landscape and commitment to cutting-edge solutions.

Early mover advantage

Gain experience and expertise in the digital asset space, becoming a trusted provider and attracting new client opportunities.

Generating New Revenue Streams

Custody fees

Offer secure storage solutions for client digital assets, generating income from custodial services.

Merchant services

Provide digital asset payment processing for businesses, charging transaction fees and value-added services.

DeFi integrations

Integrate DeFi protocols like lending and borrowing to offer enhanced financial services and generate income from platform usage.

Enhanced Security and Transparency

Robust security infrastructure

Benefit from blockchain’s inherent security features and distributed ledger technology for secure and transparent transactions.

Reduced fraud risk

Utilize blockchain’s immutability to minimize the risk of fraud and errors, increasing trust and user confidence.

Improved auditability

Leverage blockchain’s transparency for easier transaction tracking and regulatory compliance.

Building Trust and Brand Reputation

Focus on user experience

Offer a seamless and user-friendly platform for digital asset transactions, enhancing customer satisfaction and loyalty.

Commitment to innovation

Demonstrate your understanding of the evolving financial landscape and willingness to adapt to new technologies, enhancing your brand image.

ChainUp's Solutions for Payment Platforms

Loyalty Programs and Rewards

Implement crypto-based loyalty programs and reward users with tokenized incentives.

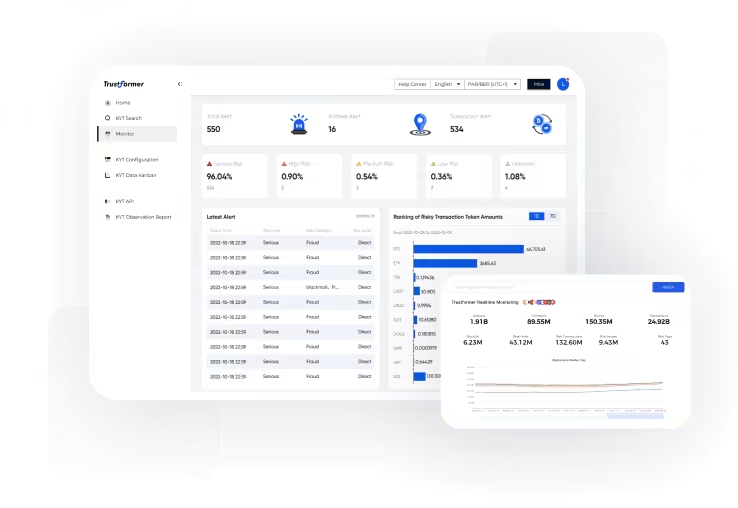

Compliance and Risk Management

Utilize blockchain-based KYC/KYT/AML solutions to streamline customer onboarding, identity verification, and transaction monitoring, mitigating financial crime risks.

Digital Asset Custody Solutions

Securely store and manage clients’ digital assets, including digital assets, tokens, and NFTs, with robust security measures and regulatory compliance.

Get in Touch Now

Let’s Speak

Start your digital assets journey today.

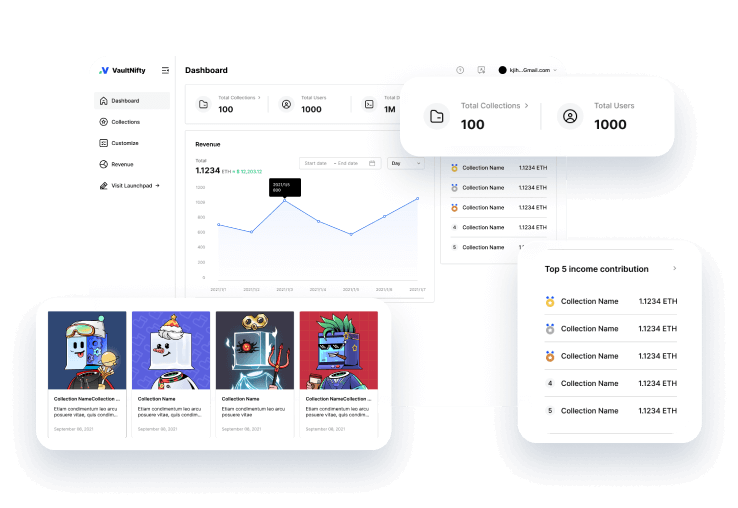

NFT Solutions

Unlock new customer engagement and brand loyalty with gamified rewards, exclusive experiences, and secure, tokenized assets, all powered by innovative NFT solutions.

Know-Your-Transaction (KYT) Risk Control Technology

Streamline onboarding, boost compliance, and safeguard client assets with ChainUp’s AI-powered KYT risk control tech for efficient and frictionless banking in the digital age.

Institutional-grade

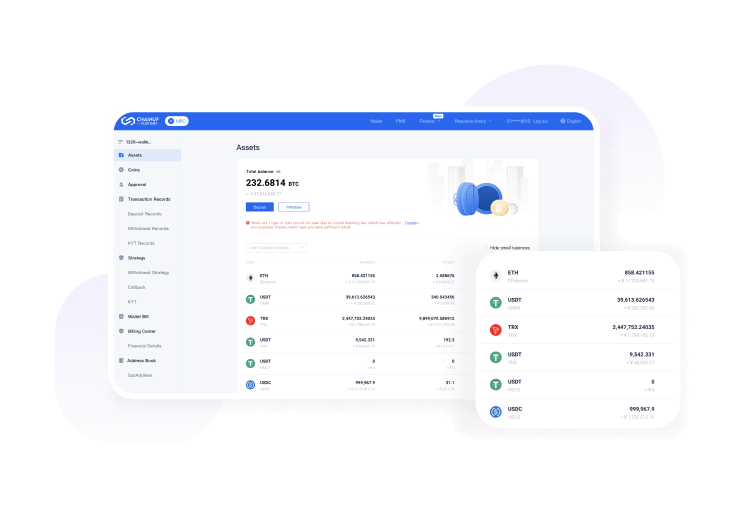

Wallet-as-a-service

Empower secure multi-asset custody, attract digital asset-savvy clients, and unlock DeFi integration with ChainUp’s seamless, scalable, and compliant Wallet-as-a-Service for future-proof commercial banking.