Boost Efficiency,

Reduce Risk

Commercial banks can tap into unprecedented efficiency and growth by embracing digital asset solutions. Streamline trade finance with faster, cheaper cross-border transactions, reduce paperwork and fraud risks with blockchain-powered processes, and unlock new revenue streams by enabling secure tokenization of traditional assets like invoices or real estate. Don’t be left behind in the digital asset revolution – embrace digital asset solutions and watch your commercial bank thrive.

Key benefits for Commercial Banks adopting digital asset solutions

Efficiency and Cost Reduction

Streamlined Trade Finance

Reduce paperwork, expedite document verification, and automate settlement with smart contracts, minimizing turnaround times and transaction costs.

Faster Cross-border Payments

Facilitate secure and efficient cross-border transactions, particularly in regions with limited access to traditional banking services.

Reduced Fraud Risks

Leverage blockchain’s inherent security and transparency to mitigate fraud risks associated with trade finance and other financial transactions.

Automated Processes

Utilize smart contracts to automate manual tasks like document verification and regulatory compliance, improving operational efficiency and reducing resource utilization.

New Revenue Streams and Market Expansion

Tokenization of Assets

Tokenize traditional assets like invoices, real estate, or private equity to improve liquidity, attract new investors, and facilitate fractional ownership.

DeFi Integration

Explore opportunities to integrate with DeFi protocols for borrowing, lending, or asset management, offering innovative financial products and services to clients.

Expand Service Offerings

Cater to a wider range of clients by offering secure custody solutions for digital assets, digital asset trading platforms, and other digital asset-related services.

Attract New Customers

Tap into the growing market of digital asset-savvy businesses and individuals seeking access to innovative financial solutions.

Competitive Advantage and Innovation

Future-proof your Business

Adapt to the evolving financial landscape where blockchain and digital asset play a growing role, positioning your bank as a leader in innovation.

Enhance Brand Reputation

Demonstrate your commitment to technological advancement and cater to the increasing demand for digital asset-based solutions, improving your brand image.

Unlock New Business Models

Explore disruptive technologies like fractional ownership, programmable payments, and decentralized financial instruments, fostering innovation and creating new revenue streams.

Differentiation from Competitors

Offer unique and cutting-edge digital asset-powered solutions that set your bank apart from traditional competitors.

Practical uses for Commercial Banks

Tokenized Asset Offerings

Facilitate the issuance and trading of tokenized securities like bonds, real estate, or private equity on secure blockchain platforms, unlocking new investment opportunities for clients.

Smart Contracts

Automating trade settlements and regulatory compliance through smart contracts can reduce costs and improve efficiency for commercial banks.

Compliance And Risk Management

Utilize blockchain-based KYC/KYT/AML solutions to streamline customer onboarding, identity verification, and transaction monitoring, mitigating financial crime risks.

Digital Asset Custody Solutions

Securely store and manage clients’ digital assets, including digital assets, tokens, and NFTs, with robust security measures and regulatory compliance.

Digital Asset Exchanges

Generate revenue from trading fees, listing fees, and other exchange-related services, creating a new income stream.

Get in Touch Now

Let’s Speak

Start your digital assets journey today.

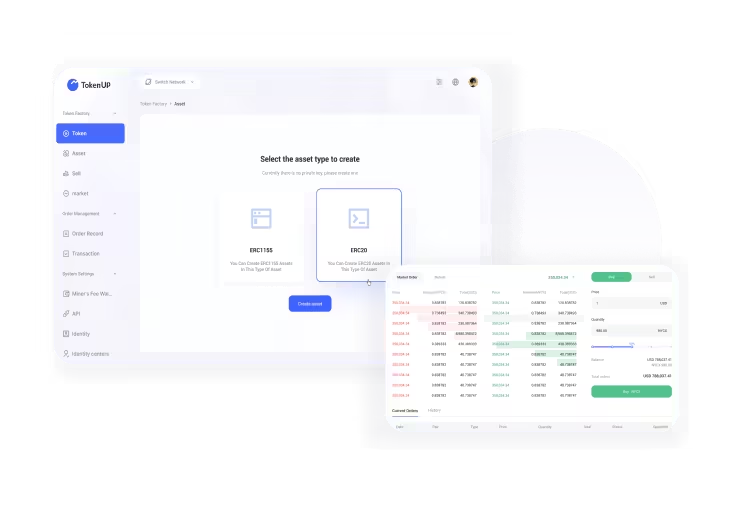

Security Tokens Offering (STO) Platform Development

Unlock new revenue streams and empower secure tokenization with ChainUp’s compliant and agile STO platform built for future-proof financial innovation.

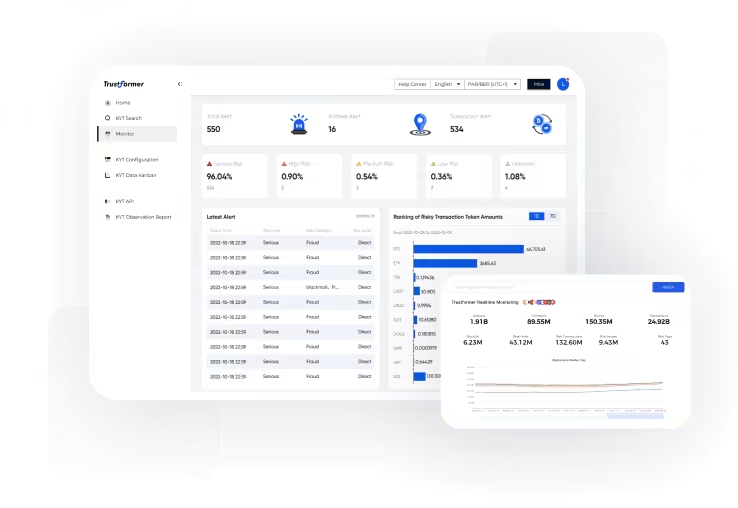

Know-Your-Transaction (KYT) Risk Control Technology

Streamline onboarding, boost compliance, and safeguard client assets with ChainUp’s AI-powered KYT risk control tech for efficient and frictionless banking in the digital age.

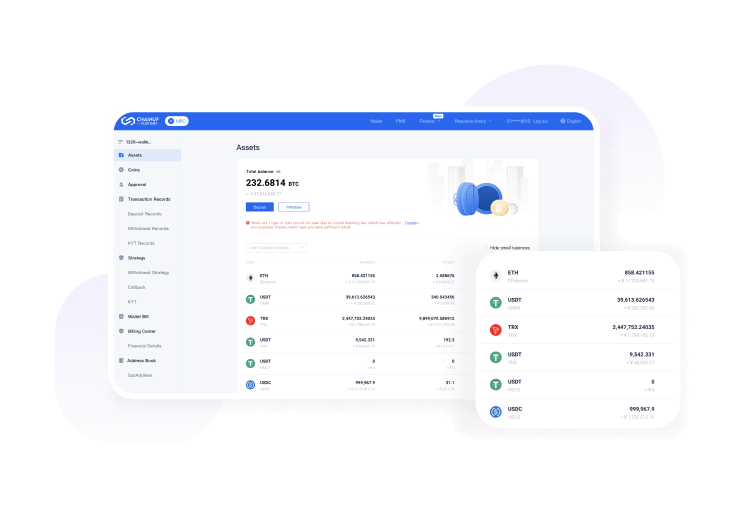

Institutional-grade Wallet-as-a-service

Empower secure multi-asset custody, attract digital asset-savvy clients, and unlock DeFi integration with ChainUp’s seamless, scalable, and compliant Wallet-as-a-Service for future-proof commercial banking.

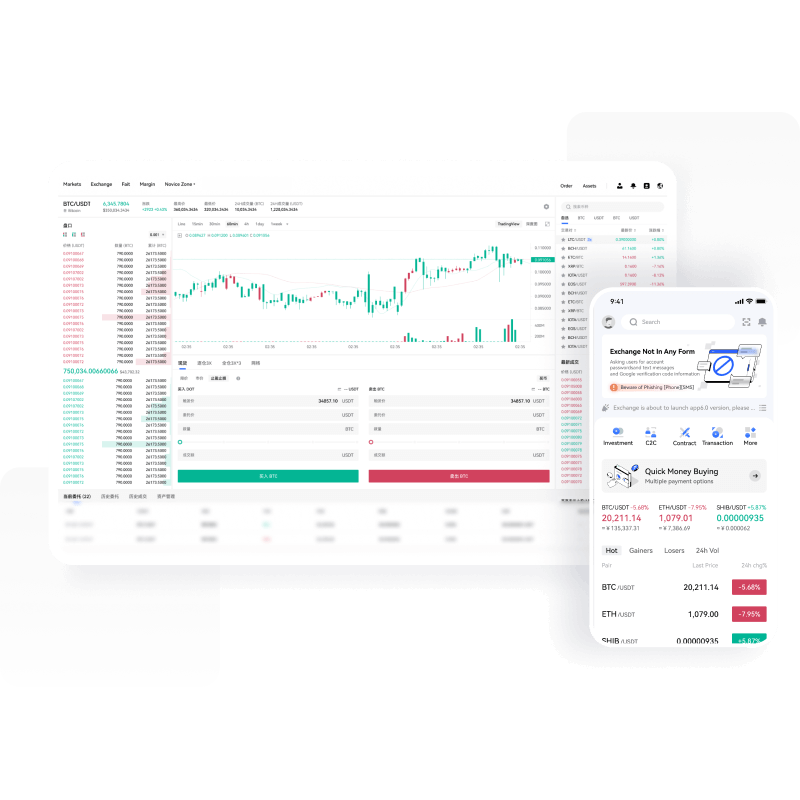

Digital Asset Exchange Platform Development

Launch best-in-class, customized and secure digital asset exchanges, unlocking new revenue streams