Don't Just Manage Assets, Manage the Future

The future of asset management lies in bridging the traditional and digital worlds. For forward-thinking firms, integrating crypto solutions isn’t a gamble, it’s a strategic play. Crypto unlocks a treasure trove of possibilities: diversify portfolios with cutting-edge assets, attract tech-savvy investors seeking exposure to the future, and generate new revenue streams through trading fees, custody services, and innovative DeFi products.

Key benefits for Asset Management Firms adopting digital asset solutions

Diversification and Innovation

Expand portfolio offerings

Offer clients exposure to a wider range of assets beyond traditional stocks and bonds, including cryptocurrencies, stablecoins, security tokens, and DeFi products.

Stay ahead of the curve

Attract tech-savvy investors seeking access to the rapidly growing digital asset market and position your firm as a pioneer in the evolving financial landscape.

Drive innovation

Develop new investment strategies and products leveraging the unique features of blockchain technology, like fractional ownership, tokenized real-world assets, and decentralized finance protocols.

Enhanced Efficiency and Performance

Automate processes

Leverage blockchain-based automation for KYC/AML compliance, trade settlement, and portfolio rebalancing, reducing operational costs and human error.

Increase transparency and security

Utilize blockchain’s immutability and cryptographic security to ensure transparent record-keeping and safeguard client assets from fraud and cyberattacks.

Improve data analysis and decision-making

Gain access to real-time market data and on-chain analytics to make informed investment decisions and optimize portfolio performance.

Access to New Client Segments and Revenue Streams

Attract millennial and tech-savvy investors

Cater to a younger generation comfortable with digital assets and seeking alternative investment options.

Tap into global markets

Leverage the borderless nature of blockchain to reach international clients and expand your customer base.

Generate new revenue streams

Earn income from trading fees, custody services, tokenized asset offerings, and innovative DeFi products.

Competitive Advantage and Future-proofing

Differentiate yourself from traditional asset managers

Offer unique value propositions with your crypto expertise and innovative products, attracting new clients and retaining existing ones.

Prepare for the future of finance

Blockchain technology is expected to play a significant role in the future of finance, and early adoption positions your firm as a leader in this emerging space.

Build trust and brand reputation

Demonstrate your commitment to innovation and forward-thinking approach, enhancing your brand image and attracting talent.

Practical uses for Asset Management Firms

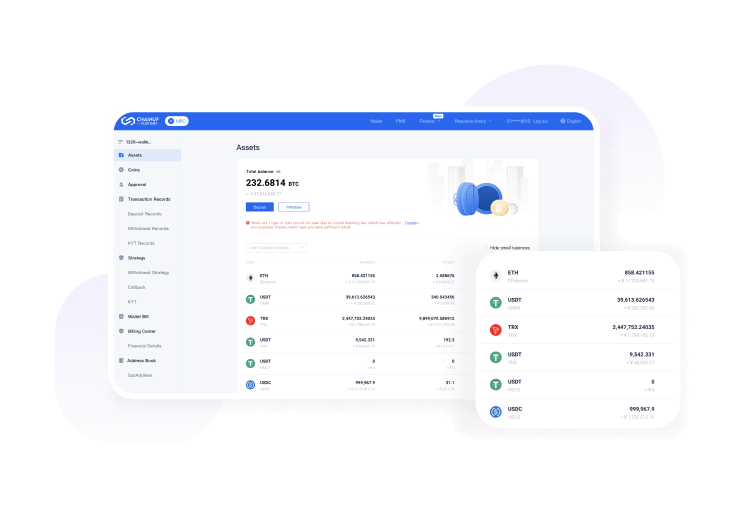

Digital Asset Custody Solutions

Securely store and manage clients’ digital assets, including digital assets, tokens, and NFTs, with robust security measures and regulatory compliance.

Compliance and Risk Management

Utilize blockchain-based KYC/KYT/AML solutions to streamline customer onboarding, identity verification, and transaction monitoring, mitigating financial crime risks.

Fractional Ownership

Enable investment in high-value assets like art or real estate through tokenization.

Optimize Portfolio Management

with Smart Contracts

Automate rebalancing, risk management, and reporting tasks.

Get in Touch Now

Let’s Speak

Start your digital assets journey today.

Institutional-grade Wallet-as-a-service

Utilize multi-signature wallets, cold storage solutions, and custody services for robust protection of digital assets.

Know-Your-Transaction(KYT) Risk Control Technology

Streamline onboarding, boost compliance, and safeguard client assets with ChainUp’s AI-powered KYT risk control tech for efficient and frictionless banking in the digital age.

Smart Contract Solutions

Automate mundane tasks, streamline processes, and open doors to revolutionary financial innovation, line by secure line.

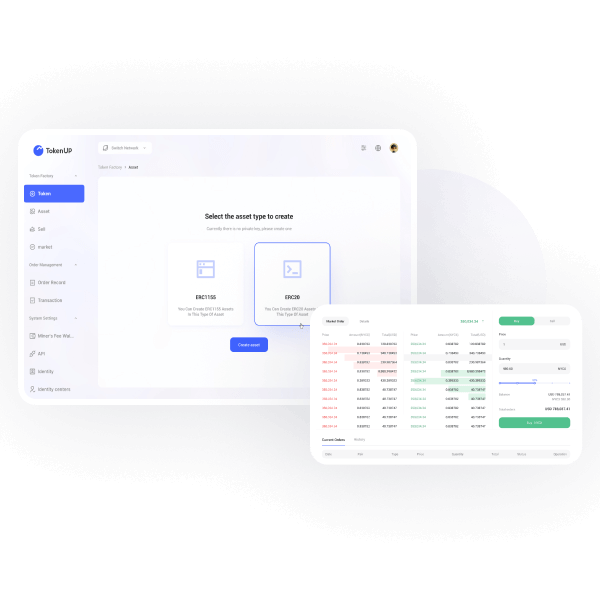

Security Tokens Offering (STO) Platform Development

Unlock new revenue streams and empower secure tokenization with ChainUp’s compliant and agile STO platform built for future-proof financial innovation.