Introduction

Bittensor was founded in 2019 by Jacob Robert Steeves, a former Google AI engineer, with the vision of building a democratized platform for artificial intelligence (AI) development. The protocol enables peer-to-peer collaboration through incentive-driven architecture, allowing participants to contribute and evaluate AI models in a decentralized manner.

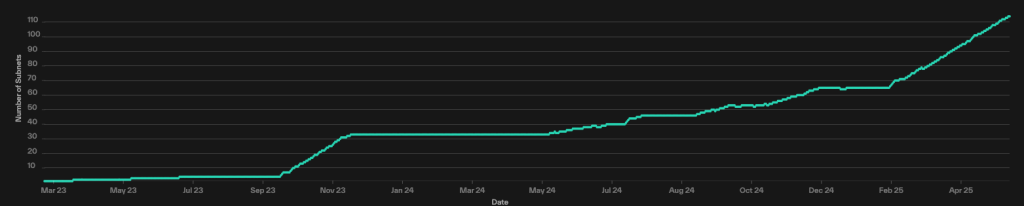

At the heart of Bittensor are specialized subnets, each dedicated to a specific AI function, such as decentralized inferencing or model training. Within these subnets, miners provide computational resources to perform tasks, while validators assess the quality and utility of those outputs using Bittensor’s unique Yuma Consensus algorithm. Yuma Consensus governs how TAO token emissions are distributed between validators and miners, rewarding participants based on the accuracy and value of their contributions. Validators who consistently deliver reliable, timely, and honest evaluations receive more influence on the consensus. However, if a validator’s assessment deviates significantly—such as overrating a miner’s performance—they risk having their bonded stake slashed. Miners, in turn, are incentivized to produce high-quality work to secure favorable evaluations and greater token rewards. This incentive structure has led to the emergence of over 113 subnets, collectively reaching a market capitalization of $3.6 billion (market cap is used instead of FDV because, in the PoW system, maximum supply differs from pre-mined total supply commonly across protocols). At its peak in December 2024, Bittensor’s overall market cap soared past $5 billion.

This article explores the key milestones in Bittensor’s development, profiles of its leading subnet contributors, a breakdown of its tokenomics, and a forward-looking analysis of its future prospects.

The Major Developments: Bittensor EVM and dTAO.

Number of Subnet in Bittensor

Since its mainnet launch in January 2021, Bittensor has faced a range of challenges, including incentive misalignments leading to low-quality outputs, centralization concerns on the root subnet, weight-copying among validators, memetic subnet exploitation, a malicious PyPI package attack, and the “runaway batch call” overload incident in May 2025.

The network and its core team have addressed these issues incrementally. For instance, the problem of low-quality outputs has been naturally mitigated by the emergence of increasingly professional mining teams such as Tensora. These teams are incentivized to maintain high standards, as poor performance results in low weight assignments, while validators who overstate a miner’s performance are penalized via Bittensor’s clipping mechanism.

To combat weight-copying—where validators duplicate the weighting decisions of others without conducting independent assessments, the team released Bittensor v7.3.0 in July 2024. This upgrade introduced a commit-reveal scheme that delays and encrypts validator submissions, ensuring that copycat validators can only access outdated weight data, thereby preserving the integrity of the validation process.

Bittensor has also endured direct security attacks. In July 2024, a malicious version of the Bittensor package was uploaded to PyPI, leading unsuspecting users to compromise their wallets upon installation. Approximately $8 million was stolen, and the chain was halted for 10 days to prevent further damage. More recently, in May 2025, the network experienced a runaway batch call attack, overwhelming the system and forcing it into “safe mode” for two days while core functionality was restored.

To address long-standing concerns around root subnet centralization and to improve incentive alignment, Bittensor introduced Dynamic TAO (dTAO) in February 2025. This major protocol upgrade introduced alpha tokens for each subnet, allowing market participants to directly stake in subnets they believe in. A subnet’s share of TAO emissions is now determined by market-driven demand for its alpha token, effectively decentralizing decision-making and reducing reliance on root subnet validators. This approach also enabled rapid scaling, with the number of subnets growing from 65 to 113 in just 14 weeks.

However, this market-based mechanism also introduced new vulnerabilities. Subnet 281, commonly referred to as the “LOL-subnet,” exploited the dTAO model by openly encouraging holders to buy its alpha token to inflate its price and secure disproportionate TAO emissions—without contributing meaningful computational work. The rise of speculative, non-AI-focused subnets prompted the Opentensor Foundation to intervene and adjust emission dynamics to protect the integrity of the ecosystem.

Another major upgrade, the launch of Bittensor EVM, marks a pivotal expansion of the network’s capabilities. By integrating Ethereum Virtual Machine compatibility, Bittensor opens the door to decentralized applications (dApps) and DeFi use cases—an evolution we will explore in detail later in this article.

The Core of Bittensor: Subnets

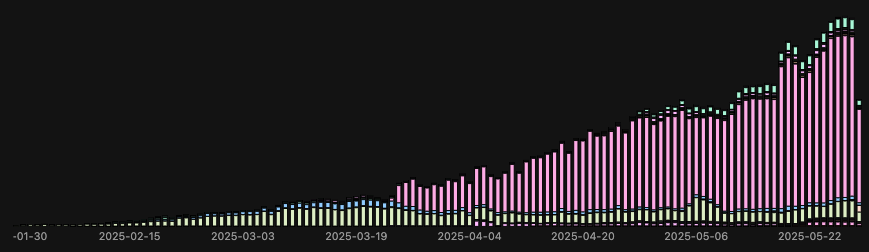

Daily Total Token Generated in Chutes Platform

Subnets are the foundation of the Bittensor ecosystem, and over time, a number of standout projects—sometimes referred to as “giants”—have emerged. Thanks to the dTAO mechanism, we can easily identify the most valued subnets by looking at those with the highest TAO emissions, as determined by alpha token market capitalization.

Top 10 Subnets by TAO Emission (as of May 2025)

1. SN64: Chutes — 14.39% Emission | Developed by Rayon Labs | Serverless AI Compute Chutes offers developers an efficient and cost-effective way to deploy AI models via a serverless platform or API—reportedly 85% cheaper than traditional cloud providers like AWS. As a decentralized system, it eliminates single points of failure and is aiming to integrate Trusted Execution Environments (TEEs) for private, miner-shielded queries. Daily token generation has surged from 6.6 billion to 101 billion in the past 3 months. Revenue (in TAO or fiat) is funneled into an auto-staking mechanism to buy back the subnet’s alpha token. Rayon Labs, the creator of Chutes, also manages SN56 (Gradients) and SN19 (Nineteen), collectively commanding 23.71% of TAO emissions.

2. SN14: TAOHash — 8.2% Emission | Developed by Latent Holdings | Decentralized PoW Mining TAOHash incentivizes Bitcoin miners to allocate their hash power to subnet validators in return for alpha tokens, supporting decentralization of Proof-of-Work (PoW) mining pools. The team is exploring expansion into other PoW assets like Kaspa and Dogecoin. In May, Latent Holdings reinvested 4.4 BTC of validator earnings into TAO, restaking it into TAOHash—potentially creating a virtuous flywheel.

3. SN56: Gradients — 6.66% Emission | Rayon Labs | Decentralized AI Model Training Gradients provides a decentralized environment for training AI models through approaches such as supervised learning, RLHF, and alignment tuning. It mobilizes distributed GPUs to cut training costs. Like Chutes, it redirects platform revenue to auto-stake its alpha token.

4. SN4: Targon — 5.73% Emission | Manifold Labs | Decentralized AI Compute Targon delivers fast, cost-effective AI inference (up to 4x faster than centralized platforms) and GPU compute services. It powers notable applications like Dippy (an AI character chat platform with 4M+ users), TAOBOT, and Sybil, an AI-enhanced search tool.

5. SN3: Templar — 5.62% Emission | Rao Foundation | Large-Scale AI Model Training Similar in goal to Gradients, Templar targets the pretraining and fine-tuning of massive AI models with 70B+ parameters, democratizing access to advanced model training infrastructure.

6. SN51: Celium — 4.44% Emission | Datura | Decentralized GPU Rental Celium, comparable to IO.net, offers affordable GPU rentals using decentralized infrastructure. It provides developer-friendly templates for frameworks like PyTorch and TensorFlow. Despite strong off-chain revenue claims, greater transparency is still awaited.

7. SN8: Proprietary Trading Network — 3.45% Emission | Taoshi | Democratized Quant Strategies This subnet crowdsources advanced, risk-adjusted trading strategies from expert traders. It enables decentralized AI and ML models to collaborate across diverse financial data. Though the alpha token currently lacks utility, it is awarded to top performers in trading competitions.

8. SN5: Kaito — 3.13% Emission | Kaito AI | Decentralized Web Search & Indexing OpenKaito ingests data from platforms like X and Discord, indexing it into a Web3 knowledge graph. Miners crawl data, maintain the index, and serve search queries. While the subnet alpha token is distinct from the Base-launched KAITO token, it is expected to gain functionality via validator APIs and embedding-as-a-service monetization.

9. SN19: Nineteen — 2.71% Emission | Rayon Labs | High-Frequency AI Inference Specializing in real-time, latency-sensitive inference, Nineteen is ideal for use cases such as assistants, autonomous agents, and industrial AI. It aims to outperform centralized giants like Mistral and OpenAI in specific real-time workloads. Revenue is used for alpha token buybacks.

10. SN9: Pretrain — 2.13% Emission | Macrocosmos | Foundation Model Training Run by Macrocosmos, a major player also manages SN1 (Apex), SN13 (Data Universe), SN25 (Mainframe), and SN37 (Finetuning)—Pretrain incentivizes the development of large-scale foundational models using datasets like Falcon Refined Web. It uses a benchmarked training approach where rewards are based on model loss scores. The alpha token currently lacks an active role.

These top 10 subnets collectively command 56.46% of total TAO emissions. However, beyond these leaders, Bittensor hosts a long tail of experimental and niche subnets, such as:

- SN59: Agent Arena – competitive agent simulations

- SN44: Athlete Performance Analytics

- SN10: DeFi Strategy Modeling

- SN25: Protein Folding

- SN93: Incentivized Content Creation

Most of these subnets are still in the price discovery phase, with many alpha tokens lacking immediate utility or direct value accrual. However, as these subnets mature, we anticipate the emergence of sustainable revenue models, improved transparency, and a significant boost to total alpha market capitalization, especially as TAO_weight continues to decline and alpha emissions surpass root emissions.

As of May 2025, emissions to alpha subnets now exceed those to the root, which gradually reduces the sell pressure from root validators, who historically sold dTAO earned via automatic distribution. This dynamic shift could mark a new era of bottom-up growth within the Bittensor ecosystem.

Bittensor (Post-dTAO) Tokenomics

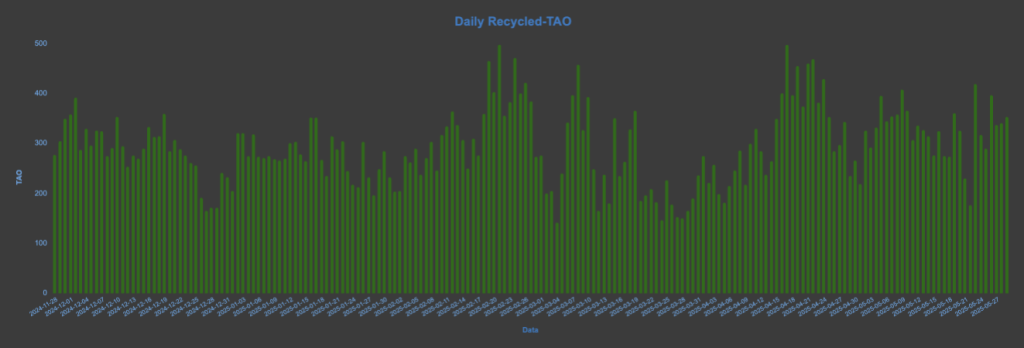

Daily Recycled TAO

The Bittensor protocol launched in 2021 with no pre-mine or ICO, featuring a fixed supply of 21 million TAO, mirroring Bitcoin’s supply cap and halving schedule. However, the introduction of the dTAO upgrade has brought significant changes to the protocol’s tokenomics.

Under dTAO, subnet creators must pay a registration fee of at least 100 TAO, although the actual amount varies depending on network demand. Upon subnet registration, up to 100 TAO is allocated to the subnet pool, while the remaining portion is burned, rather than being refundable as in the earlier design. This change reflects the fact that subnets are no longer deregistered under the dTAO framework.

Additionally, validator registration fees on the root subnet are now fully recycled, while miner and validator registration fees on individual subnets are paid in TAO and converted into the respective subnet’s alpha token. These alpha tokens are then recycled within the subnet.

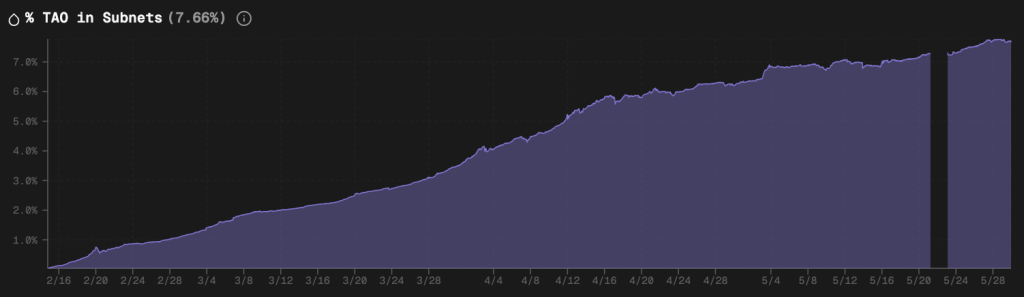

The dTAO upgrade also expanded the utility of TAO by establishing it as the liquidity base for subnet alpha tokens. When users stake TAO into a specific subnet, the staked amount is converted into the subnet’s alpha token, allowing them to earn emissions rewards based on that subnet’s allocation. As of now, 7.72% of the total TAO supply is staked across subnets.

This shift in network design, driven by subnet proliferation, increasing adoption of sustainable revenue models, and growing alpha token trading activity, is expected to significantly increase demand for TAO. Furthermore, due to the constant recycling of TAO tokens within the system, the TAO halving schedule is now delayed, with the next halving currently projected for January 25, 2026.

The DeFi Layer and Institutional Adoption of TAO

TAO Ratio Staked in Subnets

In 2025, Bittensor introduced EVM compatibility, significantly lowering the barrier for developers to deploy smart contracts and build DeFi applications directly on the network. This advancement unlocked new use cases, including liquid staking, dTAO trading, borrowing/lending protocols, and cross-chain interoperability.

Emerging DeFi Applications in the Bittensor Ecosystem

- TaoFi: Enables bridging USDC from Ethereum into taoUSD on Bittensor EVM. The team has also teased a cross-chain purchasing mechanism, allowing users to buy alpha tokens from major ecosystems such as Ethereum, Solana, and others.

- Tensorplex: Offers liquid staking for TAO on both Ethereum and Bittensor EVM. It also launched Backprop Finance, a trading platform for alpha tokens. The team is a major contributor to the ecosystem and raised an undisclosed amount from YZi Labs in March 2025.

- Taofu: Introduced tokenized representations of subnet owner keys and alpha emissions, enabling publicly funded subnet launches, democratizing access to subnet creation.

- Tao.app and Taostats: Function as explorers and platforms for alpha token trading. These platforms provide valuable insights into subnet performance and alpha token activity.

- TAO.bot and Hotkey: Offer USDT/TAO-based trading interfaces for buying and selling alpha tokens, contributing to the liquidity infrastructure of the Bittensor EVM.

- Tao Yield: Aggregates and displays staking APY data for TAO across both the root subnet and individual subnets, enhancing transparency for stakers.

- LayerZero and Hyperlane: Now support cross-chain functionality with Bittensor EVM, paving the way for further integration with the broader blockchain ecosystem.

Despite these developments, Bittensor EVM currently lacks a standardized wrapped TAO or dTAO token, which limits seamless integration with DeFi smart contracts. The team has acknowledged this and continues to actively communicate plans to deploy a canonical wrapped TAO on its weekly OpenDev Calls.

Institutional Adoption of TAO

TAO is beginning to attract institutional attention, following a trend once exclusive to Bitcoin:

- xTAO announced a merger with Adrianna Ventures, a strategic move to facilitate public listing on the TSX Venture Exchange. The project’s core operation centers around running validators on Bittensor, and it is raising $10 million to expand its infrastructure and technology stack.

- Safello, the leading crypto exchange in the Nordics, announced its first step into decentralized AI by reallocating part of its treasury, selling 1 BTC and acquiring 239.8 TAO, signaling growing confidence in Bittensor’s long-term vision.

Conclusion

Bittensor has rapidly evolved from a single-token protocol into a sprawling meta-network of specialized AI subnets, each with its own token, community, and economic model. The ecosystem is becoming increasingly dynamic, with upcoming developments such as Uniswap V3 integration and Yuma 3 aiming to further optimize validating process. Meanwhile, enhancement proposals like Proof of Weights are being actively discussed to enhance validator accountability and performance. As TAO emissions increasingly shift toward subnet-specific alpha tokens, a majority of current TAO stakers will be motivated to stake in the subnets, seeking higher yields across promising protocols. This market-driven competition has brought clear front-runners into the spotlight, including Chutes, TAOHash, and Targon, but dominance is far from guaranteed. In this fast-moving environment, today’s top subnets could easily be outpaced by tomorrow’s innovations. Many of these leading subnets were virtually unknown just months ago, and now they offer credible, investable narratives. The early phase of dTAO has already revealed significant potential. The coming months will be pivotal in determining which projects can turn that potential into sustainable value, and those are the ones worth paying close attention to.