In the early days of Bitcoin, a hobbyist could mine thousands of coins using a simple laptop CPU. Today, the landscape is unrecognizable. With Bitcoin mining difficulty increasing over 100x since 2013, the days of solo mining profitability are effectively over for all but the most massive operations.

Modern mining is an industrial-scale competition where hashpower is the currency of success. In this high-stakes environment, mining pools have emerged as the critical infrastructure layer that makes Proof-of-Work (PoW) mining viable, predictable, and scalable for institutions.

Whether you are an institutional investor exploring digital asset infrastructure or a data center operator expanding into crypto, understanding mining pools is essential. This guide breaks down exactly what mining pools are, how they function, and why they are the standard for 99% of global block production.

Why Mining Pools Matter Today

The sheer computational power required to secure networks like Bitcoin has created a “winner-takes-all” dynamic for solo miners. The statistical probability of a single ASIC machine finding a block on its own is comparable to winning the lottery—possible, but highly unlikely to happen on a timeline that supports a business model.

- Dominance: Over 99% of Bitcoin blocks are mined by pools, not solo miners.

- Difficulty: Network difficulty regularly hits new all-time highs, exceeding 100 trillion, making solo mining statistically impractical.

- Capital Intensity: High energy costs and hardware prices demand predictable revenue streams to ensure ROI.

For enterprises, mining pools solve the volatility problem. They transform sporadic, lottery-like rewards into consistent cash flow.

What Are Mining Pools?

At its core, a mining pool is a coordinated group of miners who agree to combine their computational power (hashrate) over a network to increase their collective chances of solving a cryptographic puzzle and validating a new block.

Instead of competing against each other, pool participants work together. When the pool successfully mines a block, the reward is distributed among all members proportional to the amount of computing power they contributed.

Think of it like a lottery syndicate. If you buy one ticket, your chances of winning are infinitesimal. If you join a group of 10,000 people who each buy a ticket, the group’s chance of winning is significantly higher. If the group wins, everyone splits the prize.

The Scale of Modern Pools

Today’s top mining pools are not small collectives; they are massive software platforms. The largest Bitcoin mining pools individually control 10–30% of the total network hashrate, giving them immense influence over network security and transaction processing.

How Mining Pools Work

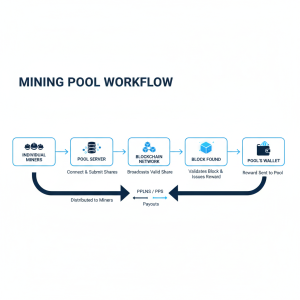

Mining pools streamline the complex process of block validation. They act as a coordinator, distributing work to thousands of individual machines and aggregating the results.

Here is the step-by-step workflow of a standard mining pool:

- Connection: A miner connects their hardware (ASIC or GPU rig) to the pool’s server.

- Work Assignment: The pool server assigns a specific “job” to the miner. To prevent miners from doing duplicate work, the pool divides the search space so each machine works on a unique range of nonces (solutions).

- Share Submission: As the miner works, it submits “shares” to the pool. A share is a valid proof of work that is difficult enough to prove the miner is working, but not difficult enough to solve the block itself. It acts as a receipt of contribution.

- Block Discovery: Eventually, one miner in the pool will find a hash that meets the network’s full difficulty target. The pool submits this valid block to the blockchain.

- Reward Distribution: The network awards the block reward (currently 3.125 BTC plus fees) to the pool’s address. The pool then calculates payouts based on the shares submitted by each member and distributes the funds.

Data Point: A single modern ASIC miner contributes less than 0.0001% of Bitcoin’s total hashrate. Without a pool, this machine might run for decades without ever earning a reward.

Mining Pool Reward Models

For institutional miners, the most critical aspect of a pool is how it calculates payouts. Different models shift risk between the pool operator and the miner.

Here are the four most common reward structures:

1. PPS (Pay-Per-Share)

- How it works: Miners receive a fixed payment for every valid share they submit, regardless of whether the pool actually finds a block.

- Pros: Guaranteed income; zero variance. You get paid for your work immediately.

- Cons: Higher fees. The pool operator takes on all the risk of bad luck (not finding blocks), so they typically charge a higher fee to cover this.

- Best for: Institutions needing predictable cash flow for financial reporting.

2. FPPS (Full Pay-Per-Share)

- How it works: Similar to PPS, but it also distributes a portion of the transaction fees included in the block, not just the block subsidy.

- Pros: Higher total revenue potential compared to standard PPS.

- Cons: Still carries higher fees than riskier models.

- Best for: Large-scale operations maximizing revenue while maintaining stability.

3. PPLNS (Pay-Per-Last-N-Shares)

- How it works: Payouts are based only on the shares submitted during a specific window (the “last N shares”) before a block is found. If the pool doesn’t find a block, nobody gets paid.

- Pros: Lower fees (often 0%–1%). This model aligns miner and pool incentives perfectly.

- Cons: High variance. If the pool has a run of bad luck, your revenue drops.

- Best for: Long-term miners comfortable with fluctuating income in exchange for lower fees.

4. PROP (Proportional)

- How it works: Rewards are distributed proportionally to shares contributed during the specific “round” (the time between two found blocks).

- Pros: Simple and fair.

- Cons: Vulnerable to “pool hopping” strategies where miners jump in only when a block is likely to be found soon.

|

Reward Model |

Fee Structure |

Risk Level |

Transaction Fees Included? |

Ideal For |

|

PPS |

High (2-4%) |

Very Low |

No |

Risk-averse institutions |

|

FPPS |

Med/High (2-4%) |

Very Low |

Yes |

Revenue maximization |

|

PPLNS |

Low (0-1%) |

Medium |

Yes |

Long-term holders |

|

PROP |

Variable |

Medium |

Yes |

Smaller private pools |

Pool Mining vs. Solo Mining

Why do institutions almost universally choose pools over solo mining? It comes down to variance and risk management.

Solo Mining

- The Model: You own your hardware and connect directly to the Bitcoin node.

- The Reward: If you find a block, you keep 100% of the 3.125 BTC + transaction fees.

- The Risk: The variance is extreme. You could mine for five years with $1 million in hardware and earn exactly $0 if you never find a block.

- Infrastructure: Requires running your own full node and managing complex connectivity uptime.

Pool Mining

- The Model: You point your hardware to a pool provider.

- The Reward: You receive small, frequent payments (e.g., daily or hourly).

- The Risk: Minimal variance. Revenue is smoothed out.

- Infrastructure: Simplified setup; the pool handles the full node maintenance and block propagation.

Key Stat: Pool mining reduces reward variance by over 90% compared to solo mining. For a CFO managing a balance sheet, this predictability is non-negotiable.

Risks and Challenges of Mining Pools

While essential, mining pools introduce specific risks that enterprise operators must vet carefully.

- Centralization Concerns: At various points, just 3 or 4 mining pools have controlled over 50% of Bitcoin’s hashrate. This centralization theoretically threatens the network’s censorship resistance, though in practice, miners can switch pools instantly if an operator acts maliciously.

- Custodial Risk: Most pools are custodial, meaning they hold your rewards until a payout threshold is reached. If the pool is hacked or the operator acts fraudulently, unpaid balances could be lost.

- Downtime: If the pool’s servers go down, your connected miners stop hashing effectively. Top-tier pools mitigate this with redundant global servers.

How to Choose the Right Mining Pool

Selecting a mining pool is a strategic decision for institutional miners. Here is a checklist for vetting providers:

- Fee Structure & Transparency: Does the pool offer FPPS for maximum revenue? Are the fees competitive (typically 1–2.5% for FPPS)?

- Uptime & Reliability: Look for 99.9%+ uptime history. Every minute of downtime is lost revenue.

- Global Infrastructure: Does the pool have servers located near your mining facility? Lower latency reduces “stale shares” (work submitted too late to count), improving profitability.

- Financial Reporting: Can the pool provide API access for real-time audit data? Institutions need automated exports for treasury management.

- Regulatory Compliance: Is the pool operator compliant with relevant regulations? Do they screen transactions to ensure you aren’t processing illicit blocks (OFAC compliance)?

Partner with Enterprise-Grade Infrastructure for the Future of Mining

As we move through 2025 and beyond, mining pools are evolving from simple aggregators into full-stack financial platforms. The future is being shaped by energy integration and financialization, with pools offering hedging products, hashrate derivatives, and direct integrations with power grids.

For the enterprise, the choice of a mining pool is no longer just about fees—it’s about partnering with a provider that offers the technical stability, regulatory readiness, and financial tooling required to scale. The mining landscape has professionalized, and your infrastructure should too. Relying on robust, secure, and compliant systems is paramount.

Ready to optimize your mining strategy for this new era? Contact ChainUp today to learn how our enterprise-grade solutions can support your growth in the digital asset ecosystem.