Attract the Best,

Invest in the Best

In today’s rapidly evolving financial landscape, venture capital and private equity firms must seize the immense potential of digital assets. These disruptive technologies offer a treasure trove of opportunities: diversify portfolios with high-growth potential in innovative blockchain-based projects, gain access to a global pool of talent and disruptive technologies, and unlock new alpha generation strategies through DeFi protocols and tokenized assets. By embracing digital assets, VC and PE firms can sharpen their edge, attract tech-savvy entrepreneurs, and secure their position as pioneers in the future of finance, where traditional boundaries blur and revolutionary ideas thrive.

Key benefits for Payment Platforms adopting digital asset solutions

Diversification and High-Growth Potential

Access high-growth opportunities

Invest in cutting-edge blockchain projects across various sectors like DeFi, NFTs, Web3, and the Metaverse, with potential for exponential returns.

Expand portfolio beyond traditional assets

Diversify beyond stocks and bonds, mitigate risk, and gain exposure to uncorrelated assets with significant growth potential.

Identify promising early-stage projects

Leverage on-chain data analysis and expert networks to identify promising startups with disruptive technologies and strong fundamentals.

Global Reach and Talent Acquisition

Access global talent pool

Attract tech-savvy founders and developers with expertise in blockchain technology and digital assets.

Expand geographical reach

Invest in promising companies located anywhere in the world, overcoming geographical limitations of traditional VC/PE models.

Build diverse and innovative teams

Foster a culture of innovation by attracting talent from the rapidly growing digital asset ecosystem.

Enhanced Due Diligence and Investment Strategies

Utilize on-chain data

Gain valuable insights into project fundamentals, user behavior, and market trends through on-chain analytics and blockchain data.

Develop data-driven investment strategies

Implement quantitative models and machine learning algorithms to identify promising projects and optimize portfolio allocation.

Perform deeper due diligence

Utilize blockchain’s transparency to assess token economics, team expertise, and community engagement for better investment decisions.

New Revenue Streams and Alpha Generation

Generate income from token management

Participate in token sales, launch VC-backed tokenized funds, and earn fees from token management services.

Develop DeFi investment strategies

Implement innovative strategies like yield farming, liquidity mining, and tokenized venture capital models for alpha generation.

Charge advisory and consulting fees

Leverage expertise to provide consulting services for blockchain startups and other industry participants.

Competitive Advantage and Market Leadership

Be an early adopter and pioneer

Position your firm as a leader in the digital asset space, attracting innovative founders and investors.

Attract tech-savvy investors

Cater to a growing segment seeking exposure to the future of finance and differentiate your offerings from traditional VC/PE firms.

Build a reputation for innovation

Demonstrate your commitment to embracing new technologies and shaping the future of venture capital and private equity.

Get in Touch Now

Let’s Speak

Start your digital assets journey today.

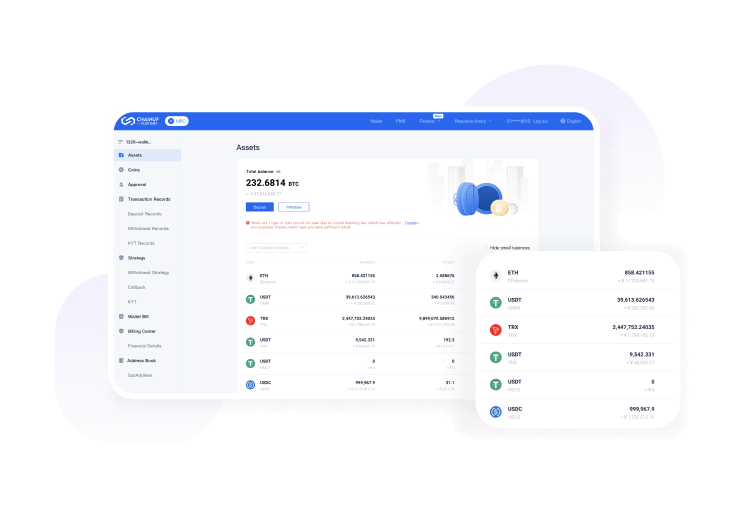

Institutional-grade Wallet-as-a-service

Utilize multi-signature wallets, cold storage solutions, and custody services for robust protection of digital assets.