Reach New Markets, Attract New Clients

Retail banks can’t afford to ignore digital asset’s potential. It promises faster, cheaper cross-border payments, attracts tech-savvy customers, and expands their reach to the unbanked. By embracing digital asset solutions like wallets and stablecoins, banks can modernize their services, unlock new revenue streams, and stay ahead of the curve in a rapidly evolving financial landscape.

Key benefits for Retail Banks adopting digital asset solutions

Enhance Efficiency and Speed

Cross-border payments

Move away from slow, expensive channels. Digital assets offer quick, cost-effective transactions, even across borders.

Micropayments

Enable seamless integration of tiny payments for digital goods or services, opening new revenue streams.

Streamlined processes

Smart contracts automate manual tasks, saving time and reducing errors.

Attract New Customers and Retain

Financial inclusion

Reach the unbanked or underbanked with digital asset wallets and stablecoins, expanding your customer base.

Gamification

Gamify banking experiences with NFTs earned for completing tasks, reaching goals, or achieving financial milestones.

Diversify offerings

Add a range of digital asset-related services like trading, custody, and investment products.

Stay Ahead of the Curve

Future-proof your bank

Adapt to the evolving financial landscape where blockchain and digital asset play a growing role.

Innovation potential

Explore cutting-edge applications like DeFi integration and tokenized assets for future growth.

Maintain relevance

Don’t let competitors corner the digital asset market; embrace it and stay relevant in the digital age.

Practical uses for Retail Banks

Cross-border Payments

digital assets can offer faster, cheaper, and more transparent cross-border transactions, potentially appealing to customers whos send or receive money internationally

Transfer

$ 1250.00

Successfully transferred

NFT Loyalty Programs

Reward customers with unique, collectible NFTs for reaching spending milestones, engaging in specific activities, or referring friend

Reward

NFT box

Has been rewarded

Financial Inclusion

digital asset wallets and stablecoins can provide unbanked or underbanked populations with access to financial services, aligning with retail banks seeking to expand their customer base

Received

+ 25 tokens

You have received 25 tokens

Get in Touch Now

Let’s Speak

Start your digital assets journey today.

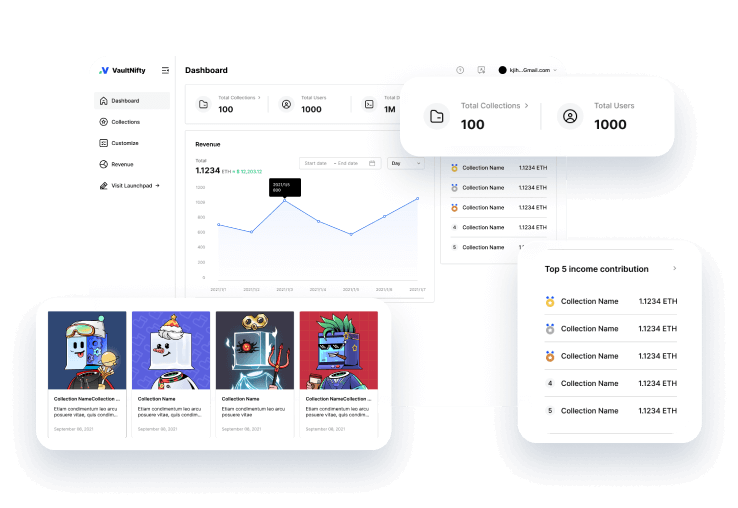

NFT Solutions

Unlock new customer engagement and brand loyalty with gamified rewards, exclusive experiences, and secure, tokenized assets, all powered by innovative NFT solutions.

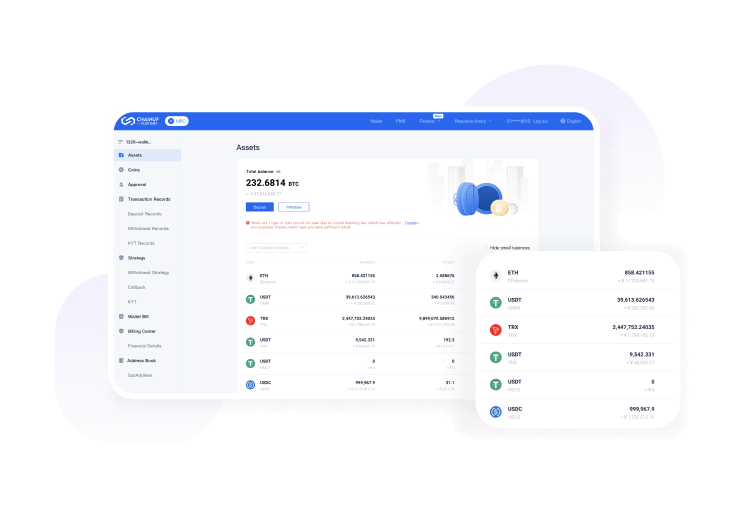

Institutional-grade

Wallet-as-a-service

Empower secure multi-asset custody, attract digital asset-savvy clients, and unlock DeFi integration with ChainUp’s seamless, scalable, and compliant Wallet-as-a-Service for future-proof commercial banking.