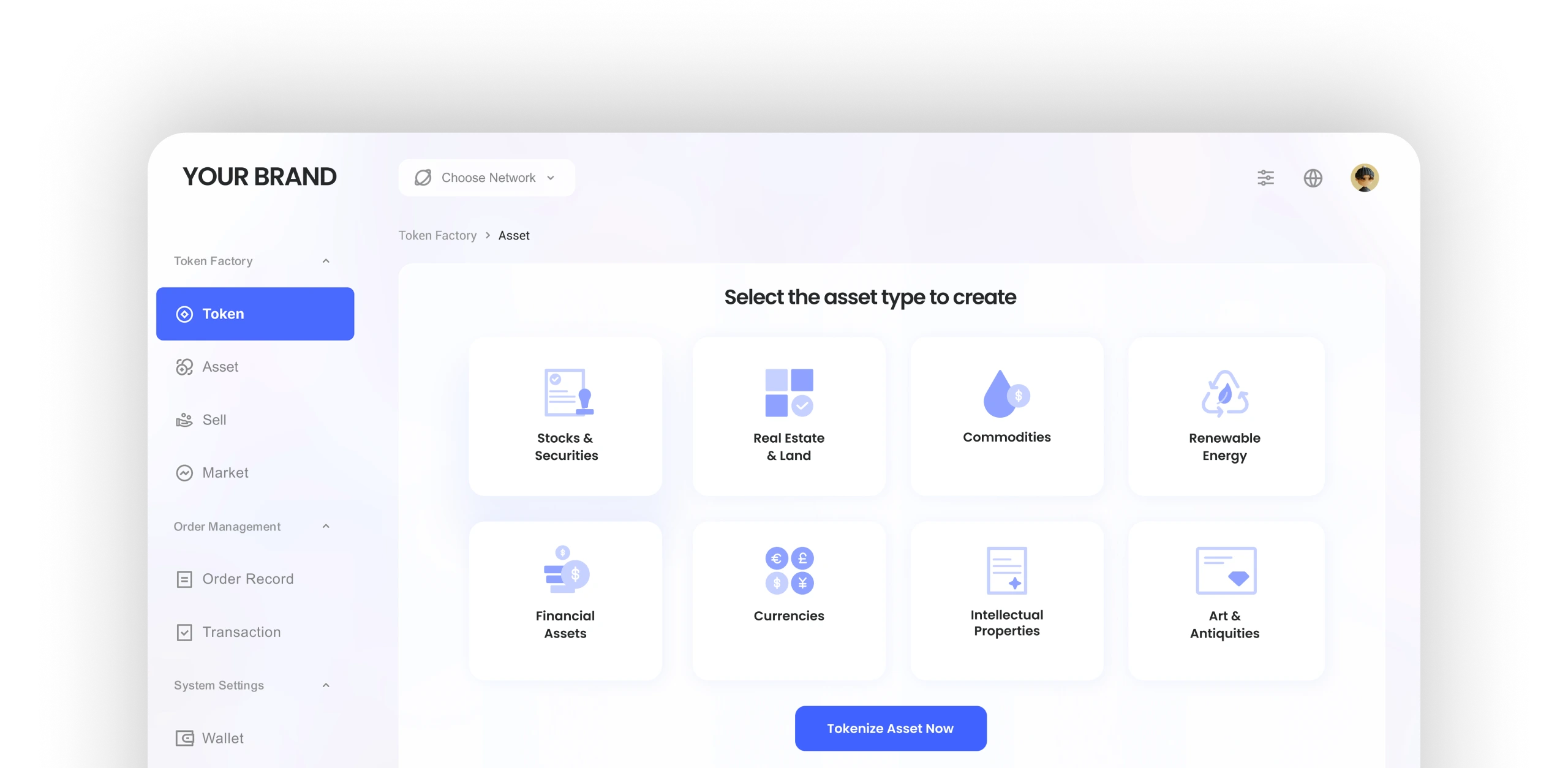

White Label Real-World

Asset Tokenization Platform

Unlock global investment opportunities through asset tokenization, while reducing capital raising time and costs with ChainUp’s all-in-one Tokenization Engine.

Effortless tokenization with professional

end-to-end support

Customizable configurations to ensure compliance with local regulations

Built-in tools for fundraising distribution

and operations

What can be tokenized?

Open up a whole new world of possibilities for how we buy, sell, and invest in real world assets.

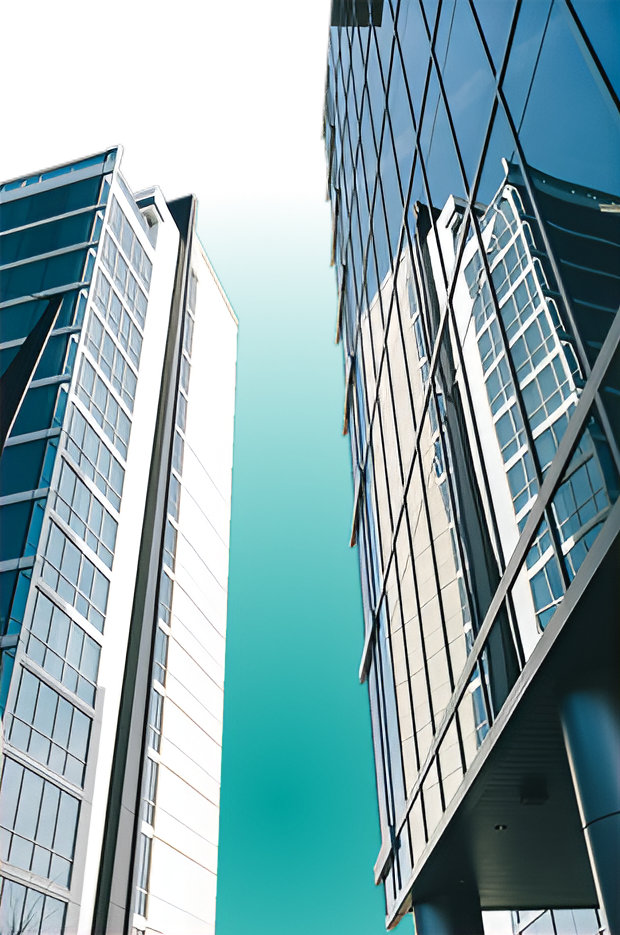

Real Estate & Land

Tokenize the rights to ownership for residential, commercial, industrial, hospitality real estate and land. Detail the specific rights associated with each token in the smart contracts that ChainUp will build.

Commodities

Tokenize the rights to ownership for precious metals like gold, energy resources like crude oil, natural gas, renewable energy credits, agricultural products, and industrial metals. Tokenizing commodities at their source – the raw material stage – opens up for early involvement and investment.

Art & Luxury Goods

Tokenize the rights to ownership for fine art, collectible cars, watches & jewelry, rare wine & spirits, luxury fashion, antiques & collectibles. The token is linked to the physical item, which is often held in secure storage.

Capital Market Instruments

Tokenize stocks, bonds, and other securities to unlock fractional ownership and streamline trading on a secure blockchain. This democratizes access to investment opportunities, enhances liquidity, and reduces transaction costs for investors of all sizes.

Currencies

Tokenize national currencies with Central Bank Digital Currencies (CBDCs) on a secure blockchain. This facilitates faster payments, greater financial inclusion, and enhanced monetary policy control, paving the way for a more efficient and accessible financial system.

Intellectual Property (IP)

Tokenize patents, copyrights, trademarks, and trade secrets, transforming them into digital assets. This facilitates fractional ownership, streamlines licensing, and automates royalty distribution, creating new revenue streams for creators. Tokenizing IP fosters a more accessible marketplace, driving collaboration and innovation.

Border color box with less gap style 2

Another Simple and easy way to show your content with less gap. Grab user attention in a more productive way.

Unlock Billions in Real-World Value through Asset Tokenization

One-stop Tokenization Process

End-to-end process that covers every aspect of tokenization from token ideation and minting to issuance, compliance, secondary trading, liquidity access, custody, and settlement – all with ChainUp’s professional consulting services and token factory.

Secure & Compliant Tokenization

ChainUp’s token factory offers robust flexibility, allowing users to tailor smart contracts to meet specific local regulatory requirements. This ensures seamless compliance while providing the adaptability to scale and evolve with changing legal landscapes.

Create New Revenue Streams

Unlock new revenue streams with a tokenization business, including minting cost, primary subscription fee, secondary market trading fee, and project listing fee.

Fundraising Distribution & Operational Tools

Token issuers can leverage integrated operational tools, including distribution network, loans, interest, dividends, campaigns, and reward systems, to attract and engage potential investors.

Smart Contract Audits & Liquidity Access

Develop, test, and audit smart contracts for STOs to ensure secure trading, while gaining access to large liquidity networks, including digital asset exchanges, OTC platforms, and upstream exchanges.

Broad Support for Asset Standards

Unlock new revenue streams with a tokenization business, including minting cost, primary subscription fee, secondary market trading fee, and project listing fee.

Why Partner ChainUp in Asset Tokenization?

Leverage ChainUp’s white label solution to generate new revenue streams through a tokenization business. With our advanced features and continuous support, customize a platform that meets your business objectives, enabling secure, compliant token issuance, efficient management, and seamless trading to drive long-term tokenization success.

Seamless Compliance & Risk Detection

ChainUp’s global compliance capabilities ensure your tokenization platform and all transactions comply with local regulations. Our KYC/AML and KYT solutions, powered by Trustformer, automatically screen investors, transaction purpose, and detect suspicious activities.

Maximum Security with Multi-layered Protection

We utilize a multi-technology approach including cryptography, anti-counterfeiting, and anti-tampering technologies, combined with multi-signature, offline storage, and smart contract audits, providing maximum protection of security and privacy for investor assets and rights.

Round-the-clock Support

Access 24/7 support from licensing and onboarding to technical and operational assistance. ChainUp’s STO engine is user-friendly and continuously evolving to ensure investors can trade with confidence and clarity.

Customizable, Scalable Solutions for Evolving Needs

We provide a modular deployment option for asset tokenization, seamlessly integrating with your existing infrastructure while ensuring interoperability. Our solution is highly customizable and scalable to adapt to the evolving needs of the market and investors.

Begin your Tokenization Journey

Connect with our team of experts to discover the power of assets tokenization.

Let’s Speak

Start your digital assets journey today.